Following our trusty computers and tablets, the smartphone is the third most popular device used to buy online.

A report carried out across the US and Europe in 2016 found that smartphones are used for 45% of all online traffic, however, only reach 38% of shopping bags and only 25% of these make it to an online purchase.

We expect these figures to evidently rise in line with improvements in payment when paying in a shop, parking ticket or public transport. Using your smartphone will no doubt adopt a laissez-faire approach and become more socially acceptable.

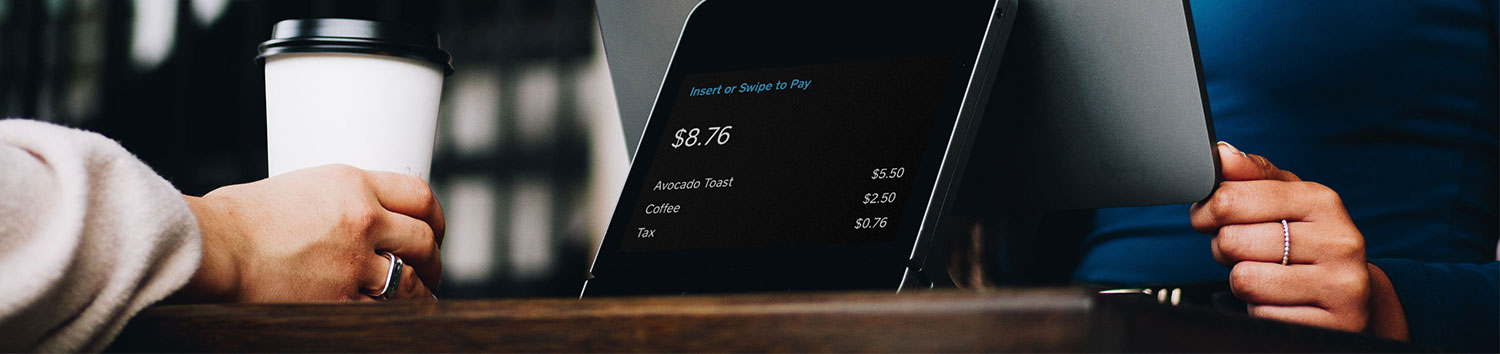

Future payment methods will ultimately change lives through developed digitalization. Cash is on its way out more, although its existence is taken longer than expected to completely die out.

The European Central Bank conducted a study which revealed that no less than 75% of all shop transactions were made with cash. It’s clear that even with this change in times, cash remains a trusted resource in our economy. Having said that, researchers at A.T. Kearney in 2016 predicted that the number of cash transactions will increase by 10% in 2020.

According to research, just over half of payment transactions are made by card, whilst all other transactions are being used less and less. Credit card payments, debit and check payments all seemed to fizzle out between 2012 and 2017, with the exception of electronic currency which rose by 1% between this time period. In Europe, electronic currency usage already amounted to 4.1% of all transactions within this time.

Thanks to our smartphones, contactless payments have become increasingly convenient in our everyday lives. The introduction of Android pay was the turning point, disregarding the use of pin code and simply link your credit card to your phone, scan your phone on the specially designed payment terminals, make the payment and go. PayPal and Google wallet are just two of the online electronic tools that act as our virtual currencies. According to the ECB, what’s known as ‘e-money’ relates to money ‘stored’ online.

Later came the Apple pay which, according to Boston Retail partners in 2017, quickly took over the market share of PayPal, which has been the largest online payment platform for some years. Nevertheless, android remains a strong candidate being built into 80% of the consumer’s smartphones whereas of course, Apple is only compatible on iPad and iPhone. There are evidently fewer mainstream applications on the market but that ultimately the principle remains the same. These include direct links to banks whereby your bank account is linked to your phone as opposed to using your card.

Soon with a selfie?

In the words of Bill Gates, ‘Banking is necessary, banks aren’t.’

It’s not just e-friendly shops that can benefit from these electronic payments. Mainstream retailers are also jumping on the bandwagon and realising that passwords and card readers aren’t always needed. Their theory is that too many customers don’t complete transactions at the payment phase. This frequently heard criticism has finally been acknowledged by the payment developers and therefore are working tirelessly on updating payment methods to include fingerprint or biometric recognition.

The Netherlands launched a pilot scheme to explore the effectiveness of biometric payments. This included individual biometrics such as fingerprints and face recognition. All users needed was to download the identity check application and scan their fingerprint. For those opting for face recognition, simply take a photo using your smartphone. These specific details are then stored on the phone until they are needed to make a payment. Of course, in any transaction, the payment would only be authorised given the recognition of fingerprint or photo. The results of this scheme showed enthusiastic results with 93% of volunteers saying they would happily continue with fingerprint recognition and 77% for selfie recognition.

Why not use social media platforms?

There have been long-standing rumours that social media platforms such as Facebook, in particular, wanting to extend their services by adding payment options to it Messenger and chat services. This is already available for American users to make money transfers but according to IT News site The Information, the company also wants to use the application for payments in external shops and online stores. Options such as ‘pay in person’ and ‘pay on pickup’ were discussed, however, owner and founder of Facebook, Mark Zuckerberg continues to clarify that Facebook is not seen as a payment service however he did acknowledge his collaboration with companies who do offer this service.

Have you ever heard of Splitwise or Snapcash? These successful social payment applications give just the proof you need that online payments can be a success. With Snapcash, users can easily send money to their friends via Snapchat just by linking their debit to their account. One swift swipe up is all it takes to send money to your pals.

The market of small users – Africa and Asia

Even though there are many European initiatives for smartphone payments, none as of yet, have become truly mainstream. These payments have however been launched in countries such as China and Kenya. Albeit a temptation to label this new revolution as a Western product, it has been born in regions where large-scale internet connections are seldom and where mobile payments are able to flourish.

In China, mobile payments are not wholly linked to just the work of mainstream banks. To name but one, the popular WeChat service plays a primitive role. The time spent on Facebook and WhatsApp amounts to the same time spent on WeChat for the Chinese. WeChat includes chatting, games, media, and payment options. With WeChat, you can spend money in stores as well as transfers to saved contacts.

The company Tencent is the sleeping partner in all WeChat activity and takes a cut from each transaction. Although what seems irrelevant in terms of how much, these individual commissions soon add up and in January 2016, Tencent reported having profited around 38 million euros. This profit comes directly from China as well as South Africa, where the application is also available. There is also the possibility to receive worldwide payments which can then specifically focus on Asian and South African tourists. Western shops are also getting on board in order to accommodate their Chinese buyers.

The CEO of Tencent revealed that the charge of transaction commission was a mere 0.1% and even less when transferring to family and friends. This processing charge comes, in a bid to encourage users to keep their virtual wallets topped up at all times.

As expected, this type of platform has attracted many Western entrepreneurs and it’s known that Facebook has been trying to exchange payments and gifts via online transactions for some time. For the time being, there is a strong sense that WhatsApp which is owned by Facebook is working on its own online payment programme based on India’s Unified Payments interface.